In the fast-paced world of financial markets, understanding and effectively utilizing volume trading strategies can be the key to unlocking significant profit potential. This comprehensive guide delves into the intricacies of volume trading in both forex and stock markets, offering traders at every level—from novices to seasoned professionals—insightful methods to enhance their trading performance. By leveraging the power of volume analysis, traders can gain a deeper understanding of market trends, enabling better-informed decisions that align with their long-term money goals.

The Essence of Volume Trading

Volume, in the context of trading, refers to the number of units of a financial instrument traded during a specified period. It is a powerful indicator that provides traders with insights into the strength of a price trend and potential reversals. High volume suggests strong interest in a security, either to buy or sell, while low volume indicates lesser interest. By analyzing these patterns, traders can predict future market movements more accurately.

Volume Trading in the Forex Market

The forex market, with its vast liquidity and 24/5 operating hours, presents unique opportunities for applying volume trading strategies. Unlike the stock market, where volume data is readily available, forex trading requires a more nuanced approach to gauge market volume. This section will explore techniques such as tick volume analysis and how they can be employed to mimic traditional volume indicators, providing forex traders with a competitive edge.

Volume Trading in the Stock Market

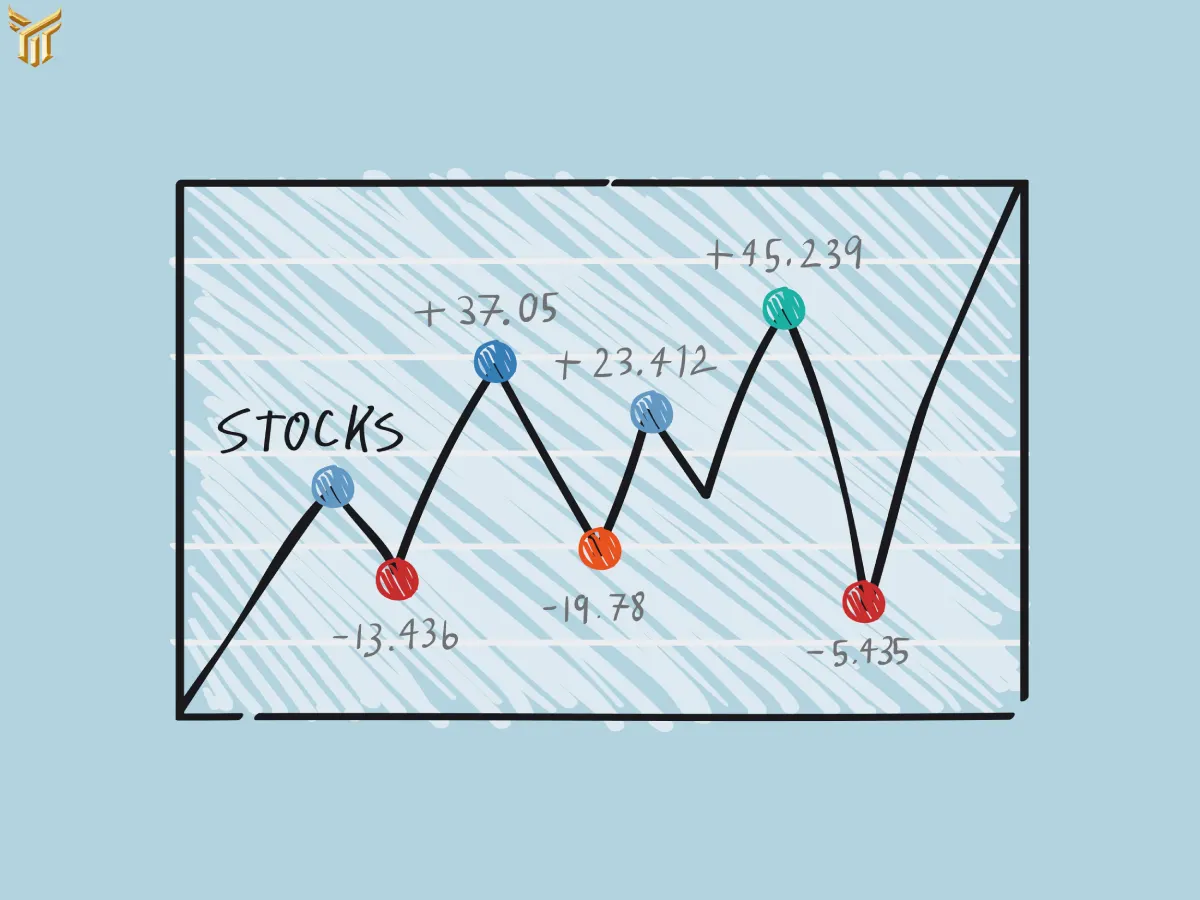

In the stock market, volume trading takes on a more straightforward approach, with readily accessible volume data. This section covers how to interpret volume spikes, volume trends over time, and volume relative to price movements. We'll discuss how these strategies can be used to identify potential entry and exit points, forecast market reversals, and confirm the strength of ongoing trends.

Integrating AI with Volume Trading

The advent of artificial intelligence (AI) has revolutionized many aspects of trading, including volume analysis. mehaholding stands at the forefront of this innovation, offering trading robots that incorporate comprehensive trading strategies for both the stock market and forex. These AI-driven tools analyze vast datasets, including volume trends, to execute trades that align with optimized strategies for maximizing returns.

_1711785404.webp)

Towards Informed Trading Decisions

This guide aims to equip traders with the knowledge to harness volume trading strategies effectively, enhancing their decision-making process in pursuit of their financial objectives. By understanding the nuances of volume trading in both forex and stock markets and leveraging the latest in AI technology, traders can position themselves to capitalize on market opportunities more efficiently.

What is Volume Trading?

Volume trading is a fundamental concept that involves analyzing the number of shares or contracts traded in a financial market within a specified period. This metric serves as a powerful indicator of the strength behind price movements, offering insights into the market's future direction. By understanding volume, traders can refine their trading strategies, making more informed decisions whether they're engaging in forex or stock markets.

The Importance of Volume in Trading Strategies

Volume plays a pivotal role in crafting effective trading strategies. It is the fuel that drives market movements, providing signals about the continuation of trends or potential reversals. High volume indicates strong interest in an asset, suggesting sustainability in the current price trend, while low volume may signal a lack of conviction among traders, possibly leading to price stagnation or reversal.

- Identifying Market Sentiment: Volume analysis helps traders gauge market sentiment, distinguishing between bullish enthusiasm and bearish caution.

- Confirmation Tool: Volume acts as a confirmation tool in technical analysis. For instance, an upward price movement with significantly high volume confirms a bullish trend, whereas the same movement with low volume might be deceptive.

- Volume Oscillators and Indicators: Tools like the Volume Oscillator, On-Balance Volume (OBV), and Volume by Price offer quantitative ways to integrate volume into trading strategies. These indicators help in identifying potential entry and exit points, making them indispensable for traders aiming to maximize their market presence.

Integrating Volume into Forex and Stock Market Strategies

While the concepts of volume trading are universally applicable, the way they're implemented can vary between the forex and stock markets due to the differences in market structure and liquidity. Forex traders might focus on volume indicators like the Money Flow Index (MFI) or Volume-weighted Average Price (VWAP) to make decisions on currency pairs. In contrast, stock market traders often rely on raw volume data and volume-based indicators to assess the strength of stock movements.

- Forex Market Considerations: In forex markets, where there is no centralized exchange, volume indicators are based on tick volume or similar metrics, providing a proxy for actual trading volume.

- Stock Market Applications: In stock markets, traders have access to precise volume data, enabling detailed analysis of market dynamics and investor behavior.

Basic Volume Trading Strategies for Forex

Volume trading strategies start with understanding the basics—how volume can indicate the strength behind price movements and signal potential trading opportunities.

- Volume and Price Action: Observing how volume interacts with price action can provide clues about future movements. An increase in volume accompanying a price rise suggests strong buying interest, often a bullish sign.

- Tick Volume Analysis: Given the decentralized nature of the forex market, traders often rely on tick volume (the number of price changes) as a proxy for actual volume. This metric can still offer valuable insights into market activity and momentum.

Advanced Volume Trading Strategies for Forex

As traders become more comfortable with basic concepts, they can explore advanced strategies that delve deeper into volume analysis.

- Using Volume Oscillators: The Volume Oscillator measures the difference between two moving averages of volume, helping identify bullish or bearish trends. A positive reading suggests bullish momentum, while a negative value indicates bearish trends.

- Volume-weighted Average Price (VWAP): VWAP gives an average price a currency pair has traded throughout the day, based on both volume and price. It is especially useful for day traders looking to make informed decisions about entry and exit points.

- Money Flow Index (MFI): The MFI is an oscillator that uses both price and volume to measure buying and selling pressure. An MFI reading over 80 suggests overbought conditions, while below 20 indicates oversold conditions, guiding traders on potential reversals.

How to Implement Volume Trading Strategies in Forex Markets

Implementing volume trading strategies requires a blend of technical analysis, intuitive insight, and an understanding of market sentiment. Here are steps to incorporate these strategies effectively:

- Indicator Selection: Choose volume indicators that align with your trading style and objectives. Whether it’s the straightforward use of tick volume or more complex indicators like VWAP, the right tools can significantly enhance trading decisions.

- Contextual Analysis: Always consider volume within the broader market context. Volume indicators are most powerful when combined with other technical analysis tools, such as trend lines and resistance levels.

- Practice and Patience: Like any trading strategy, volume trading in forex demands practice. Utilize demo accounts to hone your skills before applying strategies in live trading environments.

Basic Volume Trading Strategies for Stock Markets

The foundation of effective stock market trading lies in understanding and applying basic volume trading strategies. These strategies enable traders to identify potential entry and exit points, forecast market movements, and mitigate risks.

- Breakout Strategy: This involves identifying stocks that are breaking out of their trading range with significantly high volume, indicating strong buyer or seller interest that could lead to sustained price movements.

- Volume Moving Average (VMA): Utilizing the VMA allows traders to smooth out volume fluctuations and identify trends. A rising VMA suggests increasing interest in the stock, potentially signaling an upward price trend.

- Price Volume Trend (PVT): The PVT indicator combines price and volume to give a cumulative line that helps traders identify the strength of price moves. If the PVT rises, it indicates buying pressure, which could lead to higher prices.

Advanced Volume Trading Strategies for Stock Markets

Advanced strategies involve more sophisticated analyses, combining volume with other indicators to uncover deeper insights into market dynamics.

- Accumulation/Distribution Line: This indicator considers both the closing price and volume to determine whether a stock is being accumulated or distributed. An upward trend in the line indicates accumulation, suggesting bullish sentiment.

- On-Balance Volume (OBV): The OBV is a cumulative indicator that uses volume flow to predict changes in stock price. A rising OBV reflects positive volume pressure that can lead to higher prices.

Integrating Volume Trading Strategies with Stock Market Analysis

Incorporating volume trading strategies into overall market analysis enhances the precision of trading decisions. By combining volume data with other analytical tools, traders can construct a comprehensive view of market conditions.

- Comparative Analysis: Comparing volume trends across similar stocks or sectors can reveal underlying strength or weakness, guiding traders towards more informed decisions.

- Volume and Price Action: Analyzing the relationship between volume and price action offers insights into potential reversals or continuations in price trends. High volume coupled with significant price movements often signifies strong market interest.

Combining Trading Strategies for Forex and Stock Markets

The dynamic nature of financial markets requires traders to be versatile, adapting their strategies to suit the unique characteristics of forex and stock markets. By understanding the commonalities and differences in volume trading across these markets, traders can develop a more nuanced approach to investment.

- Cross-Market Analysis: Employing cross-market analysis involves examining volume trends in both forex and stock markets to identify global economic patterns that might impact both markets simultaneously.

- Liquidity and Volatility Considerations: While forex markets are known for their high liquidity and 24-hour trading cycle, stock markets often offer a different kind of volatility based on company-specific news and economic indicators. Traders can exploit these differences by adjusting their volume trading strategies to fit the market conditions.

Volume Analysis: The Key to Cross-Market Strategies

Volume analysis stands at the core of cross-market trading strategies, providing insights that transcend individual market boundaries.

- Market Sentiment Indicators: Volume can act as a market sentiment indicator, revealing investor enthusiasm or skepticism across markets. For instance, a surge in trading volume in forex pairs related to a specific country might precede or coincide with significant movements in that country's stock market.

- Correlation Strategies: By analyzing the correlation between volume patterns in forex and stock markets, traders can identify potential leading or lagging indicators, helping them to anticipate market moves before they occur.

Making Money with AI in Cross-Market Trading

In the realm of cross-market trading, artificial intelligence (AI) tools can analyze vast datasets, including volume trends, to uncover opportunities for profit not easily visible to the human eye. These AI systems can process real-time volume data from both forex and stock markets, offering predictive insights that enable traders to make informed decisions swiftly. By integrating AI into their trading strategies, investors can enhance their ability to profit from the interconnected movements of these two markets.

Practical Implementation of Trading Strategies

Tools and Platforms for Volume Trading

In today’s digital trading environment, the right tools and platforms are essential for implementing volume trading strategies successfully. These technologies offer traders the analytics and real-time data needed to make informed decisions.

- Charting Software: Advanced charting software provides traders with a visual representation of volume trends alongside price movements, facilitating a deeper analysis of market sentiment.

- Trading Platforms: Selecting a trading platform that offers comprehensive volume indicators and tools can significantly enhance a trader’s ability to execute volume-based strategies efficiently.

Risk Management and Volume Trading

At the heart of successful trading lies robust risk management. Incorporating volume data into risk management strategies enables traders to adjust their positions based on the strength of market signals, potentially reducing losses and safeguarding profits.

- Position Sizing Based on Volume: Adjusting the size of trades based on volume indicators can help manage risk, with larger positions in high-confidence trades and smaller positions when signals are weaker.

- Volume and Stop Loss Orders: Volume indicators can also inform the placement of stop-loss orders, ensuring they are set at levels that reflect market realities and help protect against sudden market reversals.

Achieving Long Term Money Goals with Volume Trading

Volume trading strategies, when applied judiciously, can be a powerful vehicle for achieving long-term financial objectives. By focusing on sustainable practices and consistent application of volume analysis, traders can build a portfolio that grows steadily over time.

- Consistency Over Quick Wins: Emphasizing consistent gains over speculative bets encourages a disciplined approach to trading, aligning with long-term money goals.

- Learning and Adaptation: Continuous learning and adaptation to market changes are crucial. Volume trading is not a static field; ongoing education and adjustment of strategies in response to market feedback can lead to sustained success.

Developing a Trading Plan

A well-thought-out trading plan that incorporates volume trading strategies is essential for achieving trading goals. This plan should detail the criteria for trade entry and exit, risk management rules, and how volume indicators will be used to make trading decisions.

- Setting Clear Objectives: Define what you aim to achieve with your trading activities, including specific financial goals and the timeline for achieving them.

- Evaluation and Adjustment: Regularly review your trading outcomes in the context of your long-term objectives. Use this analysis to refine your strategies and improve performance.

Navigating the Future of Trading Strategies

As we stand on the cusp of future advancements in trading, understanding the evolution and potential direction of trading strategies becomes paramount. This final section explores the anticipated trends in trading strategies, emphasizing how traders can adapt to and leverage these trends for continued success.

Innovation in Trading Strategies

The landscape of trading strategies is perpetually evolving, driven by technological advancements, changes in market dynamics, and the ever-increasing availability of data. Traders must remain agile, ready to adopt new methodologies that can offer a competitive edge.

- Algorithmic Trading: The rise of algorithmic trading has transformed the way strategies are implemented, allowing for high-speed execution and the ability to analyze vast datasets swiftly.

- Machine Learning and Predictive Analytics: Machine learning algorithms are increasingly being used to predict market movements based on historical data patterns, providing traders with insights that were previously unattainable.

The Importance of Sustainable Trading Practices

As trading strategies evolve, so does the importance of adopting practices that ensure sustainability in the long run. This involves not only financial sustainability but also ethical trading practices that consider the broader impact on the market and economy.

- Ethical Trading: Adhering to ethical trading standards helps maintain the integrity of financial markets, ensuring they remain a level playing field for all participants.

- Risk Management: Advanced trading strategies come with their own set of risks. Implementing robust risk management practices is essential to navigate these complexities successfully.

Adapting to Market Changes

The only constant in the trading world is change. Successful traders are those who can quickly adapt their strategies to align with market shifts, regulatory changes, and technological advancements.

- Continuous Learning: Keeping abreast of market trends, new trading tools, and regulatory environments is crucial for adapting trading strategies effectively.

- Flexibility and Diversification: Diversifying trading strategies to include a variety of asset classes and techniques can help mitigate risks associated with market volatility.

FAQs

1. What Are the Best Volume Trading Strategies for Beginners?

For those new to volume trading, starting with basic strategies is essential. In the forex market, focusing on volume indicators like the Money Flow Index (MFI) can provide insights into market strength and potential turning points. Stock market beginners should familiarize themselves with the Volume Moving Average (VMA) to understand how volume trends can influence price movements. These strategies offer a solid foundation, enabling beginners to develop their skills progressively.

2. How Can I Improve My Trading Strategies?

Improvement in trading strategies comes from continuous learning, practice, and adaptation. Utilizing a variety of analytical tools, staying updated with market trends, and analyzing past trades are crucial steps. Incorporating feedback loops into your trading routine—where you review, adjust, and refine strategies based on performance—can significantly enhance your trading effectiveness over time.

3. Can Volume Trading Strategies Be Applied to Both Forex and Stock Markets?

Yes, volume trading strategies can be effectively applied to both forex and stock markets, though the specific indicators and tools might vary due to the inherent differences between these markets. In forex trading, volume indicators may focus on tick volume or transaction quantity, whereas stock market strategies can utilize actual traded volume data for analysis. Understanding these nuances is key to cross-market trading success.

4. What Role Does Technology Play in Modern Trading Strategies?

Technology plays a pivotal role in modern trading strategies, offering traders advanced tools for analysis, execution, and risk management. Algorithmic trading, machine learning models, and artificial intelligence (AI) have revolutionized how traders approach the market, enabling high-speed execution and data-driven decision-making. Embracing these technologies is essential for traders looking to stay competitive in today's fast-paced markets.

5. How Important Is Risk Management in Volume Trading?

Risk management is critical in volume trading, as it helps traders minimize losses and protect profits. Effective risk management strategies include setting stop-loss orders based on volume indicators, managing position sizes, and diversifying trades across different assets or markets. A disciplined approach to risk management can significantly improve a trader's long-term success and sustainability in the market.

6. What Are Some Common Mistakes in Volume Trading and How to Avoid Them?

Common mistakes in volume trading include over-reliance on single indicators, ignoring market context, and failing to manage risk properly. To avoid these pitfalls, traders should use volume indicators in conjunction with other analysis tools, stay aware of overall market trends and conditions, and adhere to strict risk management protocols. Education and experience are key to navigating these challenges effectively.